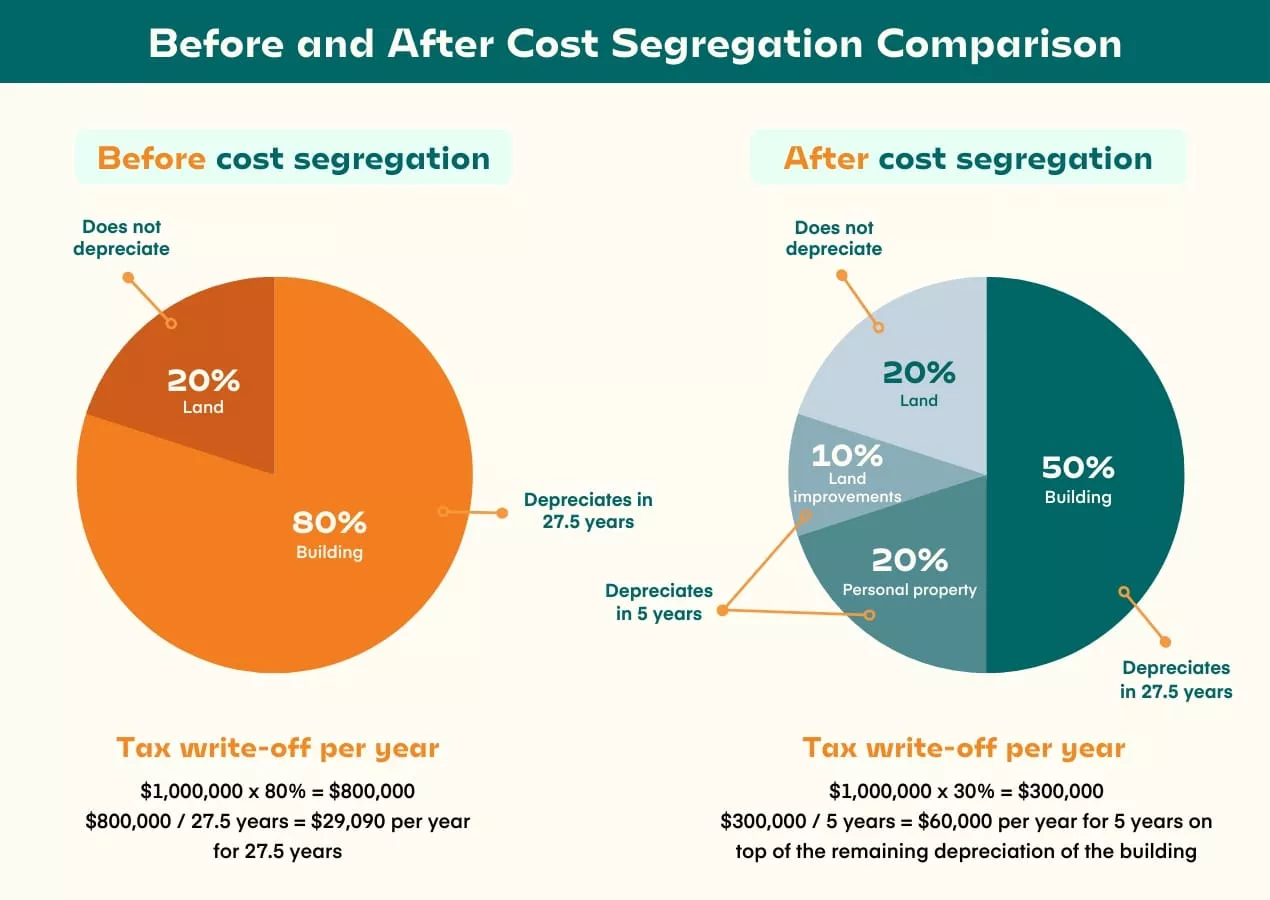

Cost Segregation is an expert analysis of a property that reduces the amount of federal and state taxes owed by accelerating the depreciation of non-permanent, non-structural items. Depreciation is a tax deduction that real estate investors can claim on their income taxes each year to help them recover the cost associated with owning, operating and maintaining that property. Using this strategy reduces the amount of money you owe on your income taxes each year. By reducing the expenses of owning investment real estate helps free up money for other investments or purchases.

The best time to have a Cost Segregation Study performed is during the same year that you buy, build or remodel a property. If you have yet to have a Cost Segregation Study performed on your property, you can have a look-back study performed. With a look-back study, you can claim a catch-up tax deduction in a single tax year. The IRS allows you to perform a look-back study on properties that you purchased, built or remodeled as far back as January 1, 1987.

The depreciation rate for real commercial property is 39 years under the current tax law. The depreciation of qualifying assets can be accelerated to five, seven or fifteen years by separating the personal property assets from the real property assets and classifying the non-structural components. This IRS program is based on the Investment Tax Credit could bring a savings of more than 20% on taxes for the depreciation of these qualifying assets of their commercial investments.

Contact us now for more detailed information on a Cost Segregation Study for your investment properties.